By Parker Lewis and Will Cole

Today, bitcoin is used principally as a long-term store of value. It is volatile and not commonly thought of as money. However, bitcoin’s logical end game is as a transactional currency facilitating direct commerce. Bitcoin will become the global unit of account and primary medium of exchange because of its fixed supply. More plainly, virtually all goods and services will be priced in bitcoin, and bitcoin will be used as a method of payment to facilitate trade for the reason that it is the only form of money that exists in the world which cannot be printed.

That is the end game and it is beginning. Fiat currencies all over the world are at various stages of failure, and the demise is accelerating broadly, which heightens the need for a more rapid shift to bitcoin. And beyond its use as just a nascent (or niche) store of value. The Argentine Peso, Lebanese Pound, Turkish Lira each have the obvious signs of hyperinflation written on the wall. While often downplayed as idiosyncratic, the rest of the world is not far behind.

If you pay attention to fiat science metrics like CPI, mainstream economists will have you believe inflation is declining. Live in the real world, buy groceries, fill up a tank of gas or realistically, buy anything that needs to be produced on a marginal basis with human time as an input and inflation continues to soar. The dollar is failing as a currency and its end game is the same as all fiat currencies. Hyperinflation. The euro, yen, pound, bolivar, yuan, ruble, peso, et al. Each is failing. Hyperinflation is going to change everything, and it’s happening.

Bitcoin is the answer, and the world is just now catching up to what many of us have known for several years. One currency, controlled by no one, accessible to everyone. With one beautiful guarantee, that no one can print it. Bitcoin is the solution to inflation, and it is also what provides hope on the other side of fiat hyperinflation. It is the light at the end of the tunnel.

But bitcoin can’t magically fill all the gaps of the fiat system simply by being a store of value, free from fiat debasement. Tools to make bitcoin a utility in facilitating direct commerce must be built in order to free bitcoin from the shackles of the fiat rails. When Silicon Valley Bank failed spectacularly (and rapidly), it reinforced the pressing need to build infrastructure that would be critical if and when reliable access to the US banking system (or really any banking system) were no longer available. What would you do–or what would you build–if access to your bank account were no longer a given?

Late last year, we each independently shared that we would be stepping back from our roles at Unchained. Unchained was and continues to be a key part of the equation. Custody free from counterparty risk is critical to bitcoin being a reliable long-term store of value. It is why we each remain clients of Unchained and why we have focused so much of our time and energy contributing to the bitcoin custody landscape. Bitcoin’s fixed supply is not of value and bitcoin cannot be an effective store of value if it were possible to lose, whether for malicious or non-malicious reasons, and that is why custody sits at the foundation.

However, bitcoin would also be of little value if it could not be exchanged. Historically, bitcoin has been exchanged predominantly for fiat currencies but now, with the decline of fiat currencies accelerating, we expect there to be a more rapid shift to bitcoin as a means of direct exchange for goods and services. This is why we’ve decided to focus our time on the payments side of bitcoin and why we’ve joined Zaprite. We see it as a necessary column to complete the shift to a bitcoin standard, and we believe now is the time. Fiat exchange is an incredibly important service but ultimately, fiat exchange is as transitory as fiat currencies.

The future of bitcoin liquidity is not dollars, euros or yen. It is goods and services–oil, power, food, cars, homes, healthcare, the arts, etc. being directly exchanged for bitcoin. Value for value. Work for work. Proof of work for proof-of-work. If we were to wait until the entire world has descended into hyperinflation to insulate our businesses and trade lines from the fiat payment system, we would have waited too long and would be in a far worse position.

Agency is about action. We focus on building the tools that we need, with the expectation that others will need them too. That was the philosophy we had at Unchained, and it’s a philosophy shared by Zaprite’s founder, now our partner, John Magill. As a contractor, John needed a tool to be able to issue business invoices to customers and be paid in bitcoin. What he wanted didn’t exist, so he set out to build Zaprite.

Fast forward a year, when we were each independently working with tools to be able to receive bitcoin payments, we realized that what we wanted also did not yet exist. This is what sparked our interest to pursue the path we did in Zaprite. We had known John from living in Austin and were familiar with Zaprite. When we researched the range of tools available, Zaprite was closest to what we would have built if starting from a blank slate–with a core use case of enabling bitcoin payments non-custodially without running a server. We also aligned very closely with John’s vision for the future of Zaprite. And more foundationally, his vision as a bitcoiner.

At its core, Zaprite is a bitcoin payments company, but it is not a payment processor. The word payments is often thrown around loosely as a catch all. In reality, there are many different types of commerce, and the structure of payments for each is dependent on the nature of any particular transaction. Oil transactions are different from real estate transactions, which are different from e-commerce, which are different from point of sale. How businesses pay contractors is also different from employee payroll. In bitcoin, payments is also typically used interchangeably to imply or as code for “lightning”. Zaprite is not a “lightning” company.

Zaprite is focused on enabling businesses to receive bitcoin payments online, with a specific focus on business invoicing as well as ecommerce checkouts. Zaprite is a hosted solution, but it is not a financial institution. We are not a custodian nor do we “route” customer payments. At Zaprite, there are no “easy withdrawals” because Zaprite never touches customer funds and enabling bitcoin payments does not require it.

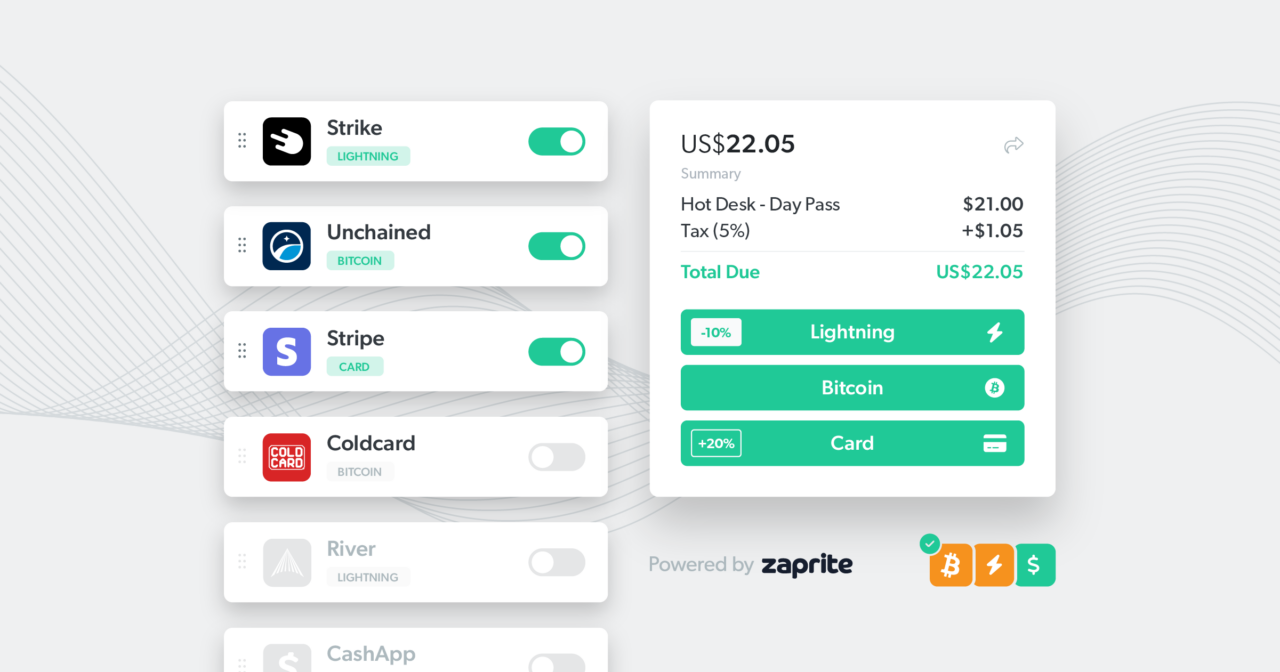

We simply help businesses receive bitcoin and you can sign up with just an email. Businesses connect a wallet (or wallets). Onchain or lightning. Custodial or non-custodial. An xpub or multisig. And we provide the software tools to make the payments experience seamless for our customers and their customers, including the reporting and accounting tools businesses need to shift to a bitcoin standard. Importantly, we also allow our customers to link a fiat payment method to provide one integrated tool for businesses to receive both bitcoin and dollars (or other fiat).

Shifting to a bitcoin standard is just that, most often a shift rather than a flash cutover all at once, and any business wanting to receive bitcoin payments almost always wants or needs to continue to receive fiat during this transitionary period. But one thing we don’t do is exchange fiat. We enable the acceptance of fiat via connections to existing rails and we focus our energy and specialization on the payment experience. We also recognize that businesses receiving bitcoin payments are often already set up with an exchange partner and don’t need another one just to accept bitcoin payments, which is why we help connect our customers directly to existing exchange partners, rather than compete for exchange.

Starting next week, you will be able to connect both a Strike account and an Unchained vault to Zaprite–which is also how we as a company will be receiving lightning and onchain payments, respectively, for Zaprite subscriptions–direct to our Unchained vault and Strike account for lightning. We also plan to support more connections over time and intend to be a complement to bitcoin exchange and financial services providers all over the world that are trusted by bitcoiners—a complement by focusing on enabling payments for businesses.

At Zaprite, we host the server solution and make payments seamless, allowing our customers to focus on their business while we help their bitcoin payments go directly where they want, without ever having to worry about the financial counterparty risk of Zaprite. If we can enable our customers to receive more bitcoin payments today, that is our key success metric (and value proposition) and it will enable us to help more and more businesses over time. Our target customers are bitcoiners who run businesses or offer professional contract services. We are focused on bitcoiners for a reason, and we are less focused on bitcoin as a rail to get back to dollars or some other fiat currency for the same. We want to develop solutions for people who actually want the bitcoin. Long-term games for long-term people.

Having a clear vision of who our customer is dictates what we build. It’s why we focus non-custodially, first and foremost. We recognize that most bitcoiners value cold storage and hold their own keys. We also know onchain payments offer an unrivaled simplicity in final settlement that is particularly attractive for larger payment amounts, which is why we focus as much on facilitating onchain payments as lightning. We see our customers pairing a non-custodial setup for onchain payments with a custodial or non-custodial setup for lightning, depending on technical proficiency. But most importantly, we focus on the payment experience while offering our customers the ability to bring their own wallet, leveraging bitcoin’s interoperability to give choice with open standards.

There will be a lot more news to come, including next week at BitBlockBoom, but we are excited to share that we are both now working on Zaprite, leading business development and product, respectively. If you are a bitcoiner looking for a better solution (or the right solution) to start receiving bitcoin payments, please reach out. You can email us at dropfiat@zaprite.com or hit us up directly.

Best,

Parker & Will